- McCall Outlook 2024

- Posts

- McCall Outlook 2024

McCall Outlook 2024

Welcome to the first annual NXT Wave Research Market Outlook. As many of you know, I have been writing annual outlooks and predictions for many years. This year is the first under my new financial education, research, and media firm – NXT Wave Research. And I have to say, I think it is the best one yet and will only get better in the years ahead.

This 2024 Market Outlook is focused on investing trends and themes that I believe will not only be relevant this year, but for many years in the future. There are over 50 investing ideas included in the outlook for you to further research if they fit your investment objectives. Remember, they are simply ideas. For access to the investments I recommend to own today you must sign up for one of my research services.

For a list of all services NXT Wave Research offers please feel free to email us at [email protected].

Here’s to a healthy and wealthy 2024!

Best

Matt McCall, Founder NXT Wave Research

Table of Contents

Trend #1: Biotech Stocks Rebound

Biotech stocks have gone through a boom-and-bust several times cycle in the past. During the last decade investors have had to endure an increased level of volatility.

Since the highs in early 2021, the SPDR S&P Biotech ETF (XBI) is down 60% - leading to a large group of investors to give up on the sector. The sell-off came after a 150% rally from the COVID-low in March 2020 through February 2021.

Outside of the large biotech stocks, the majority of the sector relies heavily on borrowing to finance the potential of bringing new drugs to market. The rapid increase in interest rates has hurt the small and mid- cap (SMID) biotech stocks that rely on borrowing more than the larger players.

According to Ernst & Young, 29% of publicly traded biotech stocks in the U.S and Europe have less than one year of cash on hand.

My view that the Federal Reserve has completed it rate hike cycle will be the number one catalyst for the biotech sector in 2024 and beyond. More specifically the smaller names that have yet to turn a profit and are more interest rate sensitive will be the biggest winners.

The biotech sector lost 20% in 2021, followed by a 26% drop in 2022.

Historically, biotech stocks do not have more than two consecutive down years and the XBI was on pace for its third consecutive year of negative returns in 2023.

That is until the XBI rallied 35% in the last two months of the year to eke out a gain of 7% for the year. Even with the two-month rally heading into 2024, the sector has greatly underperformed the overall market.

The combination of interest rates likely moving lower in 2024, the sector hitting levels not seen since 2022, and several breakthroughs on the horizon, the biotech sector is poised to outperform the overall market in 2024 and beyond.

Lastly, from a technical perspective the XBI is currently bouncing off a level that has proven to be major support in the past. The chart below shows the support line at the $65 area, which has proven to good buying opportunities in 2019, 2020, and 2022. Granted each rally was short-lived – the current bounce should last several years

Biotech Investment Ideas

ARK Genomic Revolution ETF (ARKG)

A more concentrated ETF, with only 40 holdings and with a narrow focus on stocks that are involved in the genomics sub-sector. One of my themes within the biotech sector is the continued adoption of genomic treatments, specifically CRISPR technology.

CRISPR Therapeutics (CRSP) received the first approval for a CRISPR treatment in the U.K. in November and in early December the same treatment was approved in the U.S. The stock is the second largest holding in the ETF.

SPDR S&P Biotech ETF (XBI)

The ETF offers a diversified portfolio composed of over 130 biotech stocks and has a large exposure to the SMID biotech sub-sector.

Only 6.5% of the ETF’s allocation has exposure to large-cap biotech stocks, giving the ETF leverage in the event the smaller players outperform in 2024.

Trend #2: Adoption of Obesity Drugs Continues to Boom

One of the biggest trends of 2023 was the growth of obesity drugs leading to massive weight loss for patients around the globe. The two drug companies currently approved to sell the GLP-1 drugs for obesity are Novo Nordisk (NVO) and Eli Lilly (LLY). For the year, the two stocks were up 55% and 61%, respectively.

Novo Nordisk is now the largest company in Europe at $475 billion and Eli Lilly is worth nearly $600 billion.

In November, the FDA approved Eli Lilly’s drug application for Zepbound, a GLP-1 that is used to treat obesity. The same drug is also used to treat diabetes under the name Mounjaro. Novo Nordisk’s GLP-1 for diabetes is Ozempic and is marketed under the name Wegovy for the treatment of obesity.

In 2022 sales of Novo’s diabetes drug Ozempic came in at $8.6 billion and through the first nine months of 2023 it has already exceeded that at $9.4 billion. Lilly’s diabetes drug Mounjaro recorded sales of $482 million in 2022 and through the first nine months of 2023 sales are already at $2.96 billion.

Novo’s obesity drug Wegovy reported sales of $900 million in 2022 and over $3.1 billion in the first nine months of 2023. Lilly’s obesity drug Zepbound was just approved in November 2023.

GlobalData predicts Eli Lilly’s newly approved Zepbound could have sales reach $4.1 billion by 2031. The same report predicts Wegovy sales could hit $8.1 billion by 2031 – higher due to first-mover advantage.

Morgan Stanley believes Mounjaro sales could reach $65 billion by 2030 – from less $482 million in 2022.

The estimates on potential sales of obesity drugs varies on the research firm. However, there is one clear outcome for all – this trend is just beginning. Berenberg predicts the global sale of obesity drugs could hit $80 billion by 2030 from just $5 billion today.

Guggenheim believes the market for GLP-1 drugs could reach between $150 billion to $200 billion.

Jefferies believes the global obesity market could reach $150 billion by 2031.

As you can see the numbers vary, but the bottom line is that the GLP-1 trend is not slowing and is still in the early stages. The related stocks will not go straight up, but the tailwinds created by the global obesity problem need to be addressed immediately.

According to the World Obesity Foundation (WOF), over 2.6 billion people over the age of five were

considered overweight or obese. Even more troubling is that about 1 billion were categorized as obese. The WOF believes that by 2035, over half the global population will be considered overweight or obese – about 4 billion people.

It is widely known that obesity kills and is linked to some of the worst and most prevalent diseases. The World Health Organization links 5% of all deaths globally to being overweight or obese – that is about 2.8 million per year.

To help lower issues such as cardiovascular disease, kidney disease, diabetes, and the approximately 200-obesity related ailments, it appears GLP-1 drugs could be the answer.

Obesity Drugs Investment Ideas

From an investment viewpoint, the two big players Eli Lilly (LLY) and Novo Nordisk(NVO) would be considered the safest places due to early approvals. That being said, there will likely be more GLP-1 drugs as well as obesity-related treatments approved in the coming decade.

Two companies that I believe have big upside with potential approval are Viking Therapeutics (VKTX) and Zealand Pharma (ZLDPF), they have market caps of $1.5 billion and $2.4 billion, respectively.

Others to add to your watchlist includes: Structure Therapeutics (GPCR), Scholar Rock (SRRK), Altimmune (ALT), and Biohaven (BHVN).

A trend with such a high growth opportunity will create winners outside of the primary players (drug makers). The category most closely related to the increase of GLP-1 drugs are the suppliers and the distributors.

McKesson (MCK) is the largest distributor of pharmaceuticals and medical supplies in the U.S. with a market share of about 35%. As of today, about one-third of the company’s earnings come from the distribution of specialty drugs, where GLP- 1’s are categorized. The company is currently valued at $64 billion.

Cencora (COR) is a smaller direct competitor to McKesson in the distribution of GLP-1’s and could also be a big winner in the years ahead. The company is valued at $43 billion.

The current GLP-1 drugs are delivered via injections and the companies that produce the pre-filled syringes are also investments to be considered.

Two companies to keep an eye on are Catalent (CTLT) and Themo Fisher (TMO).

Keep in mind, there are obesity drugs in FDA trials that do not require syringes and can be administered via traditional pill form.

Trend #3: Onshoring Trend Accelerates

Over the last few years there has been a trend of companies moving manufacturing operations back to the U.S. (onshoring) or a nearby country (nearshoring). Reasons behind the trend include supply chain issues, better quality control, costs of doing business with questionable countries, political pressure, more skilled workers, and transportation costs.

Since the Inflation Reduction Act (IRA) was passed there has been approximately $500 billion in new investments in the U.S. leading to the creation of over 200,000 jobs in a variety of industries. In addition to the IRA, the CHIPS and Science Act and the Infrastructure Investment and Jobs Act account for approximately $2 trillion in spending in the U.S. This alone will boost onshoring for the rest of the decade.

The 12 months ending July 2023 saw manufacturing construction spending increase 80% over the prior year. The sector with the biggest increase was electronics (semiconductor manufacturers were the driver).

In 2002, when China joined the World Trade Organization (WTO), the U.S. account for 25% of

global manufacturing output. Today that number sits around 15% as China increased its market share to 30%. This trend is starting to reverse and a renaissance for U.S. manufacturing is a trend that is still overlooked and in the early stages.

There is a plethora of stats I can share with you, but the chart below sums it up – spending is on the rise and there is a large number of U.S. companies that are and will continue to benefit.

Onshoring Investment Ideas

iShares MSCI Mexico ETF (EWW)

The U.S. is now importing more goods from Mexico than China for the first time in years. The proximity of Mexico and the better relations between the two governments are pushing U.S. companies to bring operations back to the neighbor to the south – propelling the nearshoring trend. In 2023 the ETF was up 40%, easily beating the S&P 500. It is important to note, there is a presidential election in Mexico in June that could cause some volatility.

Argan (AGX)

A small company ($615 million) that generates majority of its revenue through its power systems division. The company works on projects that include solar facilities, natural gas plants, and energy storage. The increase in manufacturing will lead to an increase in demand for energy, putting Argan in a favorable position.

Fundamentally the company trades with a forward P/E ratio of 13.9 and a price-to-sales of 0.96. The stock also pays a 2.6% annual dividend. All impressive for a small-cap company in a high-growth megatrend.

Symbotic (SYM)

The warehouse of the future will look like a sci-fi movie. Robots zipping around, forklifts driving themselves, and very few humans. This may make some people angry, but the bottom line is that it is happening. The company leading the way is Symbotic and as a $3.4 billion company, there is big upside for potential investors. It’s customers will allow Symbotic to come in and completely transform the warehouse and move it into the future.

Why would anyone spend the money to make this move? Well, labor costs for warehouse employees is

up 25% since 2000 and it is not easy to find reliable workers. Then there is the demand for a large amount of goods to be shipped same-day. When all is said and done, there is a big cost-savings in the future for companies that move to automation.

Trend #4: Uranium Bull Market

After a 12-year bear market in the price of uranium, the trend began to change last year and since that time I have changed my tune and believe the sector is in the early stages of a long-term bull market.

Uranium demand has been increasing as more countries around the globe are expanding nuclear power generation. The lofty goals of trying to become carbon neutral in the next couple of decades cannot be met without a significant increase in the amount of energy produced by nuclear power. If anyone tells you differently – they are either lying or uneducated.

The stigma that has surrounded the nuclear energy sector for decades is finally starting to subside as facts override preconceived notions. This is leading to new nuclear projects coming online in nearly every continent.

According to Bloomberg Intelligence, there are 110 new nuclear reactors set for construction, which will

increase nuclear output by 30%. By 2050, nuclear power generation is expected to double to 792 GWe.

Two of the largest countries in the world, by population, are leading the way. China is planning at least 150 new reactors in the next 15 years – with a price tag of $440 billion.

Japan, the site of the Fukushima accident, plans to restart 30 nuclear reactors by 2030. In the West, the European Union added nuclear power to its sustainable finance rules, allowing for funding for the expansion.

In early December, more than 20 countries, including the U.S., pledged to triple nuclear power capacity by 2050 at the U.N. Climate Change Summit.

Not only is nuclear energy one of the cleanest in the world, more so than wind and solar, it is also one of the safest. Nuclear also has the lowest land footprint of all major energy sources.

New nuclear facilities will lead to an increase in demand for uranium and it appears supply will not be able to keep up with the projected growth.

The price of uranium traded above $90 in late 2023 for the first time in over 15 years and is up about 200% in the last three years. If I am correct on the trend, the price of uranium could again double by the end of the decade.

As you can see in the chart, demand is projected to outstrip supply in the coming years.

The chart shows the price action of both uranium spot price (typically quoted) and the long-term uranium price since since 2000. The price of uranium is quickly approaching $100.

Uranium Investment Ideas

There are two nuclear-focused ETFs, the Global X Uranium ETF (URA) and the VanEck Uranium+Nuclear Energy ETF (NLR). Even though both focus on the nuclear/uranium trend, the two are very different. The former has a much higher exposure to uranium miners and a better way to play the trend.

The uranium miners could be one of the biggest winners if the price of uranium continues to increase as they provide more leverage to investors. One of the largest is Cameco (CCJ), a Canada-based uranium miner. The stock hit a 15-year high in 2023 and doubled in the last year, but the upside potential remains high over the long-term.

Looking out longer-term, the biggest game-changer in the industry could be the mass rollout of small modular reactors (SMR). Much smaller, easier to build, and cheaper than the construction of a massive nuclear power plant, SMRs are being developed by at least 70 different companies around the globe. From an investing viewpoint, there are not a lot of great options for investors.

There are two companies to keep an eye on, BWX Technologies (BWXT) and Centrus Energy (LEU). BWX helped build the first SMR in the U.S. and has a contract with GE Hitachi to help in the building of its SMR. Investing in the company that could ultimately help several companies build SMRs lowers concentration risk, while at the same time gaining exposure to what could be a massive trend in the next 20 years.

Centrus Energy provides high-assay low-enriched uranium (HALEU) to the nuclear industry. HALEU is uranium that is more highly enriched with uranium-235 and it will likely be the product that is used in the SMRs. of the future. The company produced HALEU at its Ohio plant, marking the first time in 70 years that a domestic company delivered enriched uranium.

Trend #5: The Housing Bubble Never Arrives

If you ask the average homeowner or wannabe homeowner of their on the housing market is in the U.S., odds are the answer would involve the words crash or bubble. The COVID-infused housing rally was fueled by a movement out of the cities to more rural areas and out of high-tax blue states to states that have better tax situations. Hence, the population booms in states such as Florida and Texas.

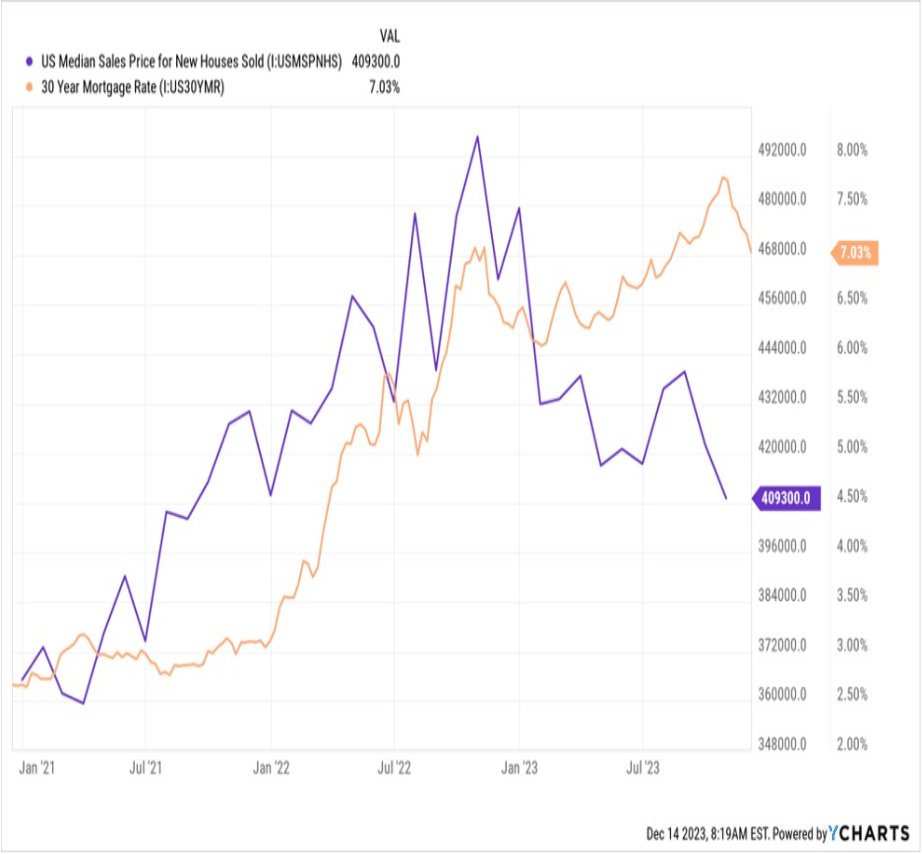

The boom in housing demand and prices was met with a surge in mortgage rates that resulted in sales falling dramatically and affordability hitting the lowest level in decades. As you can see on the chart, affordability has become a major issue for potential homebuyers due to a rapid increase in mortgage rates, prices, and low inventory.

The good news is that the average 30-year mortgage rate has fallen from a high of 7.9% in 2023 to 6.6% in December and the median sales price for new houses sold is down about 15% from the 2022 high.

The Fed has made it clear it has changed its tune on interest rates and that will likely lead to interest rate cuts in 2024. The direct correlation to mortgage rates will push down the borrowing cost for new homeowners to the 6% level by the end of 2024.

As long as wages continue to increase and inflation remains subdued, affordability will increase throughout the year. This will be why the housing bubble that most people believe is already here will be avoided.

Housing Investment Ideas

The low inventory of homes combined with a growing number of potential homebuyers will lead to more houses being built through the end of the decade. That will lead to an increase in demand for building materials that range from doors to roofs to flooring and beyond. Also helping push up demand for building materials are the homeowners that are “stuck” in their homes because they are locked in at a historically low mortgage rate and cannot sell for several years. The “stuck” homeowner will look to improve their homes leading to an increase in demand for building materials.

Beacon Roofing Supply (BECN) is one of the largest roofing companies in the U.S. that continues to grow through acquisitions. The $5 billion leader in residential and non-residential roofing trades at a cheap 0.55 times forward sales and a 10.3 forward P/E ratio.

PGT Innovations (PGTI) is a leader in the manufacturing of impact-resistant doors and windows, with the majority of its revenue generated in Florida. A strong Florida housing market and an increase in inclement weather around the country should continue to boost sales at the $2 billion company.

For a broad-based approach, the SPDR S&P Homebuilders ETF (XHB) is a diversified basket of 35 housing-related companies. About half of the portfolio is made up of building products, 35% homebuilders, and the remainder is home improvement stores and home furnishings.

Trend: Bitcoin Hits a New High

Bitcoin, the largest cryptocurrency, rallied 153% in 2023 – making it the best performing asset class in the world. In the first few days of 2024 the strength continued as bitcoin crossed the $48,000 level for the first time since April 2022. The latest catalyst was the approval of the first-ever spot bitcoin ETF.

The other well-known catalyst for bitcoin in 2024 is the halvening, which is expected to occur in April. The halvening takes place approximately every four years – it is when the reward for mining a bitcoin is cut in half. Historically, bitcoin rallies in the 12 months following the halvening, setting up the crypto for a major rally into mid-2025.

I am typically skeptical of prognosticators putting out large price targets on bitcoin. However, I do believe that the price of bitcoin could hit $100,000 during this current bull market rally by the end of 2024.

The chart shows the seasonal pattern of bitcoin going back to its beginning in 2010. Through the first two weeks of 2024, the choppy action is in-line with the last decade. As you can see, the highlighted area shows a pullback after the initial halvening spike that leads to a year-end rally that I believe sends bitcoin to $100,000 per token.

Bitcoin Investment Ideas

Investing in bitcoin has become much easier for the average investor with the early January approval of several bitcoin ETFs.

On January 10, the SEC approved 11 spot bitcoin ETFs from both large and small firms. Now the question is, which is the best option? For me it comes down to fees.Here are two low-cost bitcoin ETFs.

Bitwise Bitcoin ETF (BITB) is waiving its management fee for the first six months or until it has $1 billion under management. The fee will only be 0.2% - the lowest of the group – when it is implemented.

The ARK 21Shares Bitcoin ETF (ARKB) is also waiving its fee and will charge an expense ratio of 0.21% in the future.

The BEST of the Rest

Infrastructure Spending

Between the Inflation Reduction Act (IRA), the Bipartisan Infrastructure Act (BIL) and the CHIPs Act, the U.S is set to spend approximately $2 trillion on infrastructure projects by the end of the decade. Put another way, about $300 billion will be spent annually on infrastructure.

The majority of the money will be focused on improving transportation, energy, broadband, water projects, and other environmental issues. As big as this number sounds, it may not be enough to get the country’s infrastructure system to where it needs to be by the end of the decade.

Here are some stats from the American Society of Civil Engineers (ASCE).

43% of roads are in poor or mediocre condition – the same level it has been for years with no improvement

There is a water main break every two minutes resulting in 6 billion gallons of treated water lost every day – equal to 9,000 swimming pools

Of the nearly 620,000 bridges in the U.S., 42% are at least 50 years old and 7.5% are structurally deficient Power outages due to an inadequate energy grid cost the economy up to $169 billion annually

From water to bridges to roads to airports to the grid – trillions need to be spent to upgrade the infrastructure in the U.S. in the coming years.

There are a number of sectors that investors can focus on to take advantage of trillions being spent on the infrastructure upgrade. They include the engineering firms needed to for the projects, the building materials, and the construction firms responsible for the actual work.

Argan (AGX), previously mentioned, will be a beneficiary of the infrastructure spending in regard to upgrading the energy grid.

Another small cap company, Primoris Services (PRIM), continues to fly under the radar as a play on the upgrade of the energy sector. The company has a backlog of over $1 billion before any IRA spending has been included.

Vulcan Materials (VMC) is the country’s largest producer of construction aggregates (stone, sand, gravel) with nearly 16 billion tons of aggregate reserves. Near the top with Vulcan is Martin Marietta Material (MLM). Both companies should benefit from the word on roads, bridges, and other projects around the country.

Concrete Remains Solid

A very niche sector of the building materials industry is concrete. The chart below shows the price increase of ready-mix concrete since 2004. Other than a sideways movement during the housing bubble of 2007-2010, the price of concrete has been on a steady trajectory higher.

The trend should continue higher for a few more years helping companies that focus on the manufacturing and distribution of concrete.

Concrete Pumping Holdings (BBCP) is a small $400 million company that provides concrete pumping services and concrete waste management in the U.S. and U.K. The waste management division helps projects meet the strict environmental issues that are caused by concrete washout. The company is undervalued based on the forward P/E ratio of 9.4 and forward price-to-sales ratio of 0.82.

Insteel Industries (IIIN) is a $700 million company that focuses on steel wire reinforcing products used in the concrete construction. It’s products are used mainly in the nonresidential construction segment. A forward P/E ratio and price-to-sales ratio of 10.6 and 1.1, respectively make the company attractive on a valuation basis.

Doctor Copper

The term “doctor copper” has been used by the investment world to indicate that the price of copper is a good indicator of the overall global economy. Copper is used in everything from homes to factories to most electronics. An increase in the demand for copper is underway and will accelerate in the future as the metal is essential to the energy transition.

Solar panels use 2.8 tonnes of copper per megawatt of installed capacity.

Gasoline-powered cars require up to 66 pounds of copper. The larger electric vehicles contains up to 240 pounds of copper.

Due to its ability to be an efficient conduit, copper is needed for the massive expansion of the power grid.

There has been about 700 million tons of copper mined in the history of earth. If the world is going to meet the net zero carbon totals by 2050 – which many countries are attempting to achieve – there will need to be twice that amount mined by 2050. Everything from solar panels to wind turbines to battery storage to electric vehicles are going to push the limits of copper supply.

Even if the demand for copper comes in well below the projection of 1.4 billion tons by 2050, the likelihood of demand outstripping supply is extremely high. Thus, leading to higher copper prices in the coming decade-plus. Keep in mind that copper is cyclical and the price will not go straight up and using weakness is the best time to buy into the sector.

Some will argue that new copper discoveries and mines will come online in the future to make up for the likely deficit. While it may be true that more copper will be mined at some point in the future.

The issue is that for all the new mines that have started production since 2019, it has taken on average - 23 years from discovery to production. Most of the copper miners are based outside the U.S., but have either listings on the NYSE/Nasdaq or trade on the over the counter (OTC) market.

The largest publicly traded copper company in the world is Freeport-McMoran (FCX). The company also has mining operations for gold and molybdenum with the major focus on copper. The $55 billion international miner is a good proxy for tracking the price of copper over the long-term.

There is a plethora of smaller copper miners that carry bigger upside leverage as well as much higher risk. You either should consider buying a few to diversify or stay away entirely. One name to watch is Foran Mining (FMCXF), a $850 million Canadian exploration and development copper miner. The company is sitting on some precius property and believe

Energy Transition – The Grid

As countries around the world push to a net-zero carbon world it will require more renewable energy. The expansion of solar and wind will lead to more pressure on the electrical grid that will require major upgrades around the world, particularly in the U.S.

There are nearly 2 million megawatts of potential renewable energy sitting in interconnection queues waiting to be connected to the grid. This is due to a backlog of projects waiting to be approved by the government regulators as well as the lack of high- voltage transmission lines. This puts into perspective the magnitude of how outdated the U.S. grid is in 2024, and how it is affecting American citizens from coast-to-coast when blackouts become the norm.

I have written about the pathetic U.S. electrical grid for years and not much has improved, but that will have to change soon. Thus, leading to one of the best investment opportunities for the next 20 years.

The energy transition investment theme is a perfect example of when investors should use a basket approach. There are several niche investment trends in the larger theme that cannot be ignored and therefore it will take about 5 to 8 stocks to achieve full exposure to broad theme.

A few of the stocks I feel are a great starting point for the Energy Transition basket are...

Fluence Energy (FLNC) is a provider of hardware and software for the ever-important energy storage sector. When the sun is not shining, the energy produced during the day can be lost. When the wind is not blowing, you guessed it, the energy can be lost. Unless there is an energy storage plan to harness the energy for times when renewables are not the best energy option. Fluence combines both the cloud and AI to the energy storage offering and has quickly become a favorite of mine as a small $2.4 billion that is on the verge of profitability.

MYR Group (MYRG) is a $2.4 billion holding company that has 13 subsidiaries, some that are over a century old. There is a big focus on the energy grid transition that ranges from transmission and distribution of electricity to the installation of new renewable energy projects. Even though the stock is near an all-time high, there is plenty of upside based off valuations in the coming year-plus.

SPX Technologies (SPXC) is a $4.5 billion company that manufactures transformers for the electrical distribution industry. It also has two other divisions that focus heating and ventilation products as well as detection and measurement technologies. High voltage transmission lines and new transformers will be in high demand as the grid upgrades begin. The other two divisions will also see growth as the construction and infrastructure theme gains steam as mentioned earlier in the report.

Global Interest Rate Cuts

Three major central banks are expected to lower interest rates in the next 12 months. The Federal Reserve is expected to lower the Fed Funds rate by between 1.5% and 1.75% by the end of 2024 – taking it down to a range of 3.5% to 4.0% from 5.25% to 5.5% today. The European Central Bank and the Bank of England are expected to follow the trend and lower their respective interest rates beginning in 2024.

The odds are high this will be the outcome and it will help a slew of asset classes including specific equity sectors, bonds, and real estate. On the other side, lower interest rates could hurt the financial sector (banks and insurers) as well as asset classes tied to the current interest rate, such as a money market fund.

Smaller is Better

The Magnificent 7 (Apple, Amazon, Microsoft, Alphabet, Nvidia, Tesla, and Meta Platforms) led the market rally in 2023. The worst performer was Apple (+48%) and the leader was Nvidia (+239%). The average gain of the 10 stocks was an unbelievable 111% versus a gain of 24% for the S&P 500.

The equal weight S&P 500 index was up 13.7% in 2023, lagging the market cap weighted S&P 500 by the largest annual margin since 1998. An equal weight index is where every stock begins the rebalance period with the same percentage. Market cap weighted indices, such as the traditional S&P 500, are weighted by size, which leads to the largest stocks making up the majority of the portfolio.

If we move lower down the list of U.S. companies, last year saw the smaller stocks underperform their larger counterparts. The S&P 500 (the 500 largest publicly traded U.S. stocks) easily beat the S&P 600 Midcap and S&P 400 Small cap indices in 2023. In the last two months, the smaller stocks made a valiant effort, but it was not enough to catch the big guys.

The underperformance has led the smaller stocks to trade at valuations well below that of the S&P 500 and only reached a few times in the last 20 years. I believe the small and midcap stocks as well as the equally weighted S&P 500 will outperform the S&P 500 this year.

The Invesco S&P 500 Equal Weight ETF (RSP) offers exposure to the equal weight investment thesis with a low expense ratio of 0.2%.

There are several ETFs that can help investors gain exposure to the smaller stocks. Two to keep an eye on are the iShares S&P Smallcap 600 Index ETF (IJR) and the iShares S&P Midcap 400 Index (IJH).

Longevity

Anyone who follows me knows that longevity is one of my personal passions that I share often in my writings and podcast. The health and wellness aspect of longevity fits well with my long-term investment strategy. I visit the Princeton Longevity clinic every 18 months for a check-up that focuses on preventative health care. And I am not the only one, more people every year are seeking out longevity clinics that offer preventative offerings that include full body MRIs that are able to detect very early-stage cancer, heart ailments, and even genetic predispositions.

The longevity trend is still in the very early stages and that is why it is mentioned here. It will be a

theme that investors cannot ignore in the future and is why it will have an entire chapter dedicated to the topic in my upcoming book. A few of the areas that are considered investable at this time in the theme include diagnostics (early testing for disease), biotechs concentrating on neurological disorders, as well as gene-editing companies.

Unfortunately an ETF does not exist to captures the longevity theme in a manner I believe is acceptable. This is a trend where investors will have to build their own ETF through the basket approach. A few stocks to keep an eye on in 2024 and beyond that could give investors exposure to the trend are listed below.

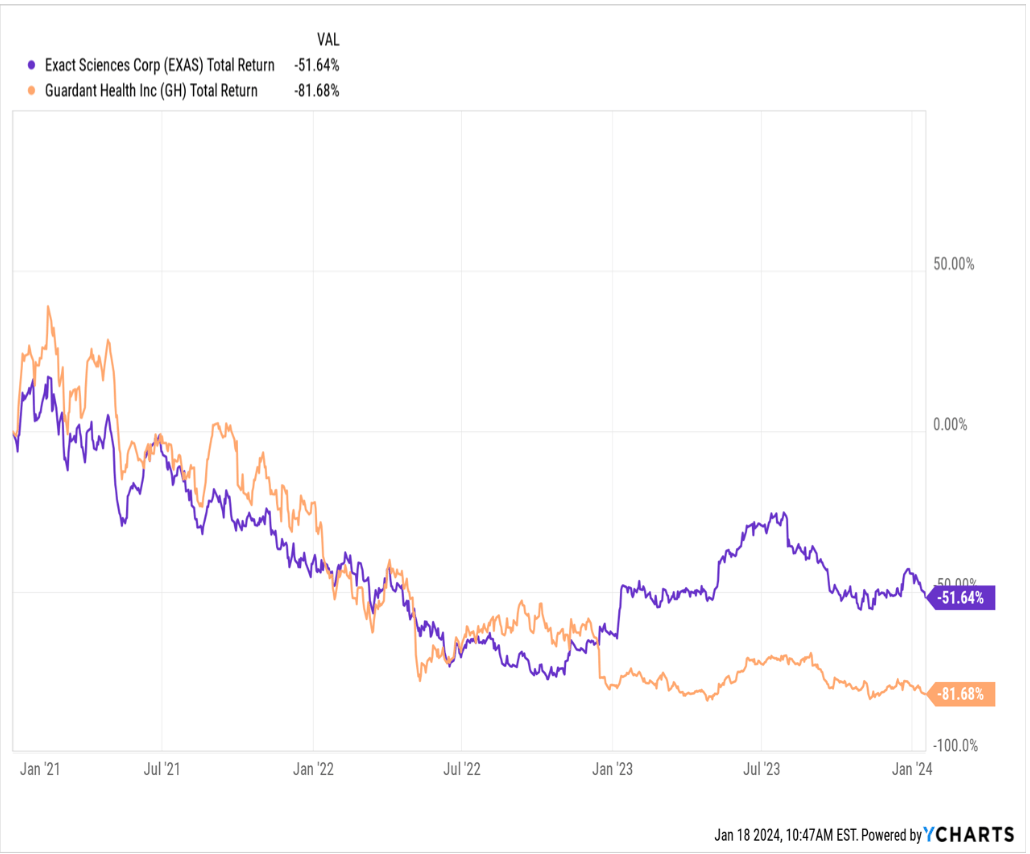

Two companies in the diagnostics that are carving niche businesses are Guardant Health (GH) and Exact Sciences (EXAS). Guardant is taking a “blood first” approach early detection of cancer. The company believes its total addressable market could reach $70 billion. Exact Sciences is a company you may have not heard of, but I bet you saw a commercial for its lead product – Cologuard – the home test for colon cancer.

When it comes to neurological diseases, Alzheimer’s disease is one that biotechs around the world are racing to find a treatment. There are FDA-approved two treatments for Alzheimer’s in the U.S. – both were created by a partnership between Biogen (BIIB) and Eisai (ESAIY). Eli Lilly (LLY), famous for its diabetes and obesity drugs, is expected to receive approval for an Alzheimer’s treat in 2024.

A few of the smaller players to keep an eye on are Prothena (PRTA), Axsome Therapeutics (AXSM), Acumen Pharmaceuticals (ABOS), Annovis Bio (ANVS), Cassava Sciences (SAVA). Small cap biotech stocks that rely on the potential of one or a few treatments are extremely risky investments. Once again, the basket approach must be used to lower potential risk.

Cybersecurity

There is no debating that AI will affect every industry in the years ahead. With the positive changes that accompany the AI revolution, there will be issues that also arise. One example is that as AI improves the life of many, it will also improve the ability of the hackers trying to attack individuals and companies around the globe.

While AI will allow for companies and individuals to automate processes and improve production and security. On the other side of the internet there are hackers utilizing the exact same tools to gain access to your information. This will lead to an increase in the need for sophisticated cybersecurity software that will be driven by AI.

Research firm Gartner believes corporate spending on cybersecurity will increase by 14% in 2024 to $215 billion.

The largest ETF focused on the niche sector is the First Trust NASDAQ Cybersecurity ETF (CIBR), which had an impressive gain of 40% in 2023. Some of the top holdings that could see a large share of the $215 billion in corporate spending include CrowdStrike (CRWD), Pal Alto Networks (PANW), Zscaler (ZS). Others to consider are CyberArk (CYBR), Fortinet (FTNT), and Rapid7 (RPD).

AI and Drug Discovery

Artificial Intelligence could be mentioned in nearly every investment theme in this outlook, however one area that cannot be overlooked is drug discovery. On average it takes more than a decade from discovery to FDA approval for a new drug, with costs will likely exceed $1 billion, and the odds of success are slim.

By incorporating AI into the process, it will help in all three aspects and could lead to 50 more novel therapy discoveries in the next decade according to Morgan Stanley.

The chart above shows the steady increase in the amount of investment into the AI drug discovery sector. In 2022, the annual total reached $24.6 billion – more than triple the amount from 2018. Morgan Stanley also expects AI to represent 11% of healthcare budgets in 2024.

Over 60% of drug companies are already implementing AI in the drug discovery process and there are a small group that focus the majority of their business on using AI. Below is a list of a few of the stocks.

Recursion Pharmaceuticals (RXRX) is a biotech firm that is using is AI-based drug discovery platform for in-house development as well as working with other large drug firms. In July the company made headlines after it received a $50 million investment from AI leader Nvidia (NVDA). The company will use Nvidia’s cloud platform to train its AI models.

Others in the niche area include Schrodinger (SDGR), Exscientia (EXAI), Absci (ABSI), Abcellera Biologics (ABCL), Relay Therapeutics (RLAY), and Evotec (EVO).

Geopolitical Uncertainty

Simply turn on the news or look at your iPhone for the latest happenings in the world and the headlines will be littered with stories of conflict around the world. Money spent on defense budgets globally continues to reach new records and the winners are the companies that are making and supplying the weapons. In 2022, $2.2 trillion was spent globally. Late last year, NATO decided it needed to resupply its nations with weapons after supplies were depleted due to Ukraine war and now Israel conflict – setting up for even more spending in the years ahead.

The iShares U.S. Aerospace & Defense ETF (ITA) underperformed the market in 2023 by 10%, but I believe that trend will change as countries in the Western hemisphere restock their weapons cache. There are also more hotspots around the world flaring up in the Middle East and Taiwan that could spark even more spending.

There are a few defense companies in the U.S. and overseas to watch. They include Howmet Aerospace (HWM) and L3Harris Technologies (LHX) in the U.S. In Europe, two of my favorites are German company Rheinmetall (RNMBY) and U.K.-based BAE Systems (BAESY).

Be Prepared for the Unexpected

Every year there are themes that the majority of Wall Street prognosticators and economists agree upon. As we all know that the masses are typically very bad at predicting the future and therefore, as an investor you need to be ready for the unexpected. Here are a few situations that may arise that most are not predicting.

Inflation begins to rise again

Inflation has been trending lower since peaking in June 2022 and the consensus is that this trend will continue or at worst the inflation rate stabilizes in the 3% area. What if energy prices spike due to a war in the Middle East? Could the Ukraine war escalate send agriculture prices higher? What if China and the U.S. get into an argument and supply chains are once again interrupted? All the above situations are possibilities that could lead to a resurgence of inflation.

The Fed begins to raise interest rates

The Fed is done has been the headline and the trend in the 10-year treasury yield suggests it is correct. I am with the masses, however as I just mentioned, inflation could rear its ugly head again and if it does it will put the Fed in a tough situation. The odds are low, but its possible.

The U.S. Dollar rallies

The greenback tends to follow the yield on the 10- year treasury and if the consensus that inflation will continue lower and that the Fed is done, then the U.S. dollar should move lower. As you can see several of these counter-ideas are related. If the Fed raises interest rates or inflation picks back up, expect the U.S. dollar to surprise the masses with a rally.

The U.S. Presidential Election is smooth

Let’s be real, most of us are beyond frustrated with the government and the two likely candidates. The country remains polarized and the two parties rarely agree on much. The one thing most of us can agree on is that this election cycle could be the biggest circus in the history of this great country.

Now, assume that is goes smooth and that it is not contested and there are no riots, it will be good for the economy and stocks. And on the flipside really back for gold and other safe havens.

Homerun Trade #1: IWM LEAPs

Small cap stocks have been discussed a few times and homerun trade number one is an investment based off the high probability the asset will outperform in the next 12-18 months. The iShares Russell 2000 Index ETF (IWM) is pulling back from a breakout to an 18-month high and if this uptrend resumes it will breakout again and test the all-time high of $244/share. I will go a step further and call for the IWM to hit a new all-time high of $260 by the end of 2024. That would result in a gain of about 36% from the current price ($191).

Instead of buying shares of IWM, the trade will be to buy the $200 June 20th 2025 Call for approximately $18.00 per contract.

Here are a few scenarios based off where IWM will close 2024. If IWM closes the year at $245 it will result in a gain of about 175%. A new all-time high at the $260 level would create the opportunity to bank a gain of 260%. If IWM reaches either level prior to the end of 2024, the gains will be even higher. On the flip side, if IWM closes out the year at $200 the loss will be approximately 30%. For the trade to be breakeven, IWM would need to close in the $208 area.

This is an aggressive trade, but at the same time the downside is limited due to buying the calls, with leverage on the upside.

Homerun Trade #2: China Tech - Kinda

The Chinese tech stocks have been underperforming its peers for a few years and are now trading at valuations that are near all-time lows. Several top holdings in the KraneShares China Internet ETF (KWEB) are trading with price-to-sales ratios not seen in over a decade. There is a huge opportunity in 2024 and beyond to buy large, successful companies at valuations that may not be seen again.

However, the trade will be the KraneShares China Internet Covered Call ETF (KLIP). The ETF invests at least 80% of its assets in the components of KWEB, but it sells covered calls against the holdings. The current dividend yield is an unfathomable 66%. Yes, you read that correctly. The current price is $15.02 and the last three monthly dividends averaged $0.67 per share!

Last year KWEB end down 22% versus a total return (dividends included) of 9.6% for KLIP.

The reason to choose KLIP is due to the limited downside if Chinese tech stocks continue to lag - the ETF should still generate a positive return. The downside is that if Chinese tech stocks rally, it will underperform KWEB. I like the downside protection and at the same time have exposure to the undervalued Chinese tech sector.

Homerun Trade #3: Japanese Yen

The Federal Reserve is set to lower interest rates in 2024 as the Bank of Japan is expected to raise its benchmark interest rate. This will lead to the Japanese Yen outperforming the U.S. Dollar throughout the year.

As you can see in the chart - there is a direct inverse correlation between the yield on the 10-year Treasury and the Japanese Yen-U.S. Dollar exchange rate. This trade has a high probability of coming to fruition and is a good strategy to diversify a portfolio that is likely heavily invested in equities.

The Invesco CurrencyShares Japanese Yen (FXY) is a low-cost investment vehicle to take advantage of this opportunity. The ETF tracks the price in U.S. Dollars of the Japanese Yen.

Homerun Trade #4: Emerging Markets Basket

The decade-long underperformance of the emerging market sector has created an opportunity that cannot be overlooked by investors. Underperformance has led to low valuations versus the developed markets, in particular the United States. As you can see in the chart, the MSCI Emerging Market Index is trading at a 55% discount to the S&P 500 – levels rarely reached.

According to Goldman Sachs, the emerging markets share of the total global stock market will reach 35% by the end of the Roaring 2020s, up from 27% today. In short, the emerging markets need to be a part of all equity portfolios.

This is the perfect situation for my basket strategy. The goal is to gain exposure to a variety of regions, sectors, and investment themes across the emerging market asset class. This will lower company, country and industry-specific risks and at the same time have little effect on the potential reward.

Here is a list of stocks that could be a great starting point for a 2024 and beyond emerging markets basket.

I have heard, “India is the next China” theme for several years and I am guilty of joining the masses with buying into the premise. This is a situation where I believe the “made-for-TV” quote has a lot of validity to it. India is now the most populous country in the world and differs from China in that it has a much younger demographic and is still in the early stage of GDP growth.

As the country grows and the middle class expands, the construction industry will see double-digit growth for the foreseeable future. A company in the middle of this boom is APL Apollo Tubes Limited (APLAPOLLO.NS), India’s largest manufacturer of structural steel tubes. The $5 billion company does not trade in the U.S. and interested investors will need to have a brokerage that allows the purchase of stocks that trade on foreign exchanges.

China Shenhua Energy (CSUAY) is a large Chinese company that has several divisions in energy with a focus on coal. The thought of investing in a coal company in 2024 may seem crazy, but the renewable energy transition will take decades and in the meantime, countries like China are more than willing to burn coal to keep energy prices down.

Arco Dorados (ARCO) operates McDonald’s restaurants in 20 Latin American countries. The leader of the fast-food stores in the region is different from the U.S.-based McDonald’s because the majority of Arco’s are company owned versus franchise owners. The upside potential for expansion in the region and the direct ties to the consumer are the two reasons to make the company a core emerging markets holding.